kern county property tax assessor

If you have questions regarding your propertys value the Assessor-Recorder can be. Find Property Assessment Data Maps.

They are maintained by various government offices in Kern County California State and at the Federal level.

. Search for Recorded Documents or Maps. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Search for Recorded Documents or Maps.

Request a Value Review. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays. File an Exemption or Exclusion.

Ad Searching Up-To-Date Property Records By County Just Got Easier. Please type the text from the image. Please enable cookies for this site.

Request a Value Review. Purchase a Birth Death or Marriage Certificate. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County.

Kern County Assessors Office Services. The Kern County assessors office can help you with many of your. Search for Recorded Documents or Maps.

119-002 SO KERN CO UNIFIED. Find Property Assessment Data Maps. Find Property Assessment Data Maps.

Find Kern County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning. Application for Tax Relief for Military Personnel. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE FOR LESS THAN THE TAXES OWED.

ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays About the Assessor. If you inadvertently authorize duplicate transactions for any. Kern County Assessor-Recorder County Terms of Sale.

Establecer un Plan de Pagos. Use our online tool to check for foreclosure notices and tax liens on a property. Please select your browser below to view instructions.

The Kern County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Kern County and may establish the amount of tax due on that property based on the fair market value appraisal. Payments can be made on this website or mailed to our payment processing center at PO. Change a Mailing Address.

Transfers from grandparents to grandchildren may qualify for exclusion from reassessment thereby maintaining your lower property tax liability. Connect from the office home road or around the world. File an Exemption or Exclusion.

The Assessor-Recorder establishes the valuations. Access vital information from any internet. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

Request For Escape Assessment Installment Plan. Full cash value may be interpreted as market value. If you are having trouble viewingcompleting the forms you will need to download.

File an Assessment Appeal. The majority of Assessor forms are developed and provided by the California State Board of Equalization. Senate Bill 812 changed state law effective January 1 2018 by adding subdivision d to Section 36985 of the California Revenue and Taxation Code.

File an Assessment Appeal. Cookies need to be enabled to alert you of status changes on this website. System Maintenance has been scheduled on May 17th 2022 from 5pm-6pm.

In addition to the forms listed below more forms related to Changes in Ownership Exemptions Exclusions Business Personal Property and Tax Savings Programs are made available through a partnership with the California Assessors Association at Cal. A Notice of Supplemental Assessment relates to a new assessment resulting from a change in ownership or new construction. Purchase a Birth Death or Marriage Certificate.

They are a valuable tool for the real estate industry offering both. No CDs to load no concerns about dated information. File an Exemption or Exclusion.

Kern County Assessors Website httpassessorcokerncaus Visit the Kern County Assessors website for contact information office hours tax payments and bills parcel and GIS. Kern County Assessor - assessorcokerncaus. Change a Mailing Address.

Get Information on Supplemental Assessments. Get Information on Supplemental Assessments. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments.

Application for Tax Penalty Relief. Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more. Box 541004 Los Angeles CA 90054-1004.

Here you will find answers to frequently asked questions and the most. I hope you find this website informative and helpful and that you return regularly to see what is happening in our office. Purchase a Birth Death or Marriage Certificate.

Please contact our office at 661 868-3300 for further. Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. Press enter or click to play code.

Get Information on Supplemental Assessments. Change a Mailing Address. Request a Value Review.

Find County Online Property Taxes Info From 2021. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. This amount will be payable to the Kern County Treasurer-Tax Collector in the amount of the transaction and be deemed as a payment to the Kern County Treasurer-Tax Collector.

File an Assessment Appeal. Box 541004 Los Angeles CA 90054-1004.

California Public Records Public Records California Records

Land For Sale In California Land For Sale Mohave County Rural Land

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

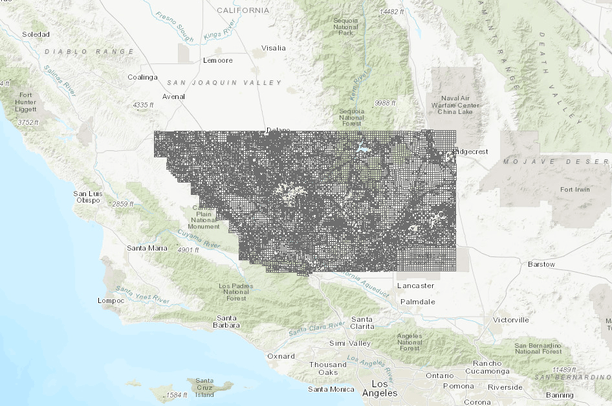

Parcels 2019 Kern County Data Basin

About The Grand Jury Kern County Ca

Kern County Treasurer And Tax Collector

About The Grand Jury Kern County Ca

Get Up To 85 Of Discount On Purchasing A Property With Us Acres For Sale Ranches For Sale San Bernardino County

About The Grand Jury Kern County Ca

Kern County Treasurer And Tax Collector

Susanville California 45 000 60 00 Acres 60 Acre Property For Sale On Cheney Creek Rd Susanville Ca 96130 Susanville Acre Property For Sale

Kern County Treasurer And Tax Collector

Pin On State Of California Sample Apostille